Financial implications for the climate change policies on the oil industry have been studied and analyzed for some time now. Oil industry has shown at best a reluctant behavior in acceptance of these new climate change policies and incorporating them into their operating and financial structures. Companies have shown varied response to environmental regulations, for e.g., BP and Shell have instituted internal GHG (green house gas) trading programs to reduce operational emissions and to learn about emissions trading markets, while Exxon Mobil has been vocal in its opposition to climate change policies especially the Kyoto Protocol. Kyoto Protocol has not been able to achieve the desired results of reduced GHG emissions as US failed to ratify the Kyoto protocol in 2001. Fig. 1 shows the possible scenario whether or not US ratifies the Kyoto protocol. What ever the case, without balanced regulations, Oil industry might suffer financially which will have an adverse affect on economies world wide and particularly in the US. Understanding how the regulations or treaties such as Kyoto will affect the Oil industry, and then working a middle way out, will help achieve the target of reduced GHG emissions from Exploration and production industry.

Fig 1. The possible scenario if or if not US ratifies the Kyoto protocol.

No matter what the scenario is, stricter regulations on the oil industry will lead to decreased share holder values for the companies, thus adversely affecting them. This will be discussed later in the blog.

No matter what the scenario is, stricter regulations on the oil industry will lead to decreased share holder values for the companies, thus adversely affecting them. This will be discussed later in the blog.

- The extent to which the climatic laws may impact the oil companies is dependent on the following;

The percentage of oil and gas produced by the company. The greater the oil percentage in the energy mix, the more restrictions the company might face due to the high carbon density in the crude oil. Therefore crude oils with higher carbon density might need further processing in the refineries in order to meet the stricter new climatic policies. - Upstream and downstream business activities. Upstream activities are likely to be impacted more as a policy change, as upstream activities are major source of green house gases and a large part of revenue for oil companies is derived from upstream activities. The risks for upstream and downstream activities are as follows.

Increased refining costs

Increased drilling costs

A possibility for reduced demand for oil

Refined products from refineries may be impacted in a significant way. - The location of reserves which has shifted to more environmentally sensitive regions such as in the African region. Significant environmental regulations will lead to production from these assets being limited or even in the worst case companies may be denied access to these reserves. As traditional oil-producing regions mature, the industry is increasingly exploring and producing in new areas, where environmental and social controversies may be significant. Figure. 2 shows the distribution of revenues for various companies from environmentally sensitive areas.

Fig 2. The distribution of revenues for various companies generated from environmentally sensitive areas.

In a somewhat secret report drafted for The Department of Energy, Advanced Resources International analyzes the economic effects of the regulations recommended by various environmental groups. The salient regulations include

· Oil and gas exploration and production (E&P) operations should report to the Toxic Release Inventory (TRI), which requires considerable expenditure in researching the toxicity of what is being produced from the well, and ultimately debating the legislations on such issues and modifying them to suite both the environmental agencies and the oil industry

· Identifying the emissions of oil and gas E&P activities according to the National Emission Standards for Hazardous Air Pollutants (NESHAP) program, and pushing the U.S. Environmental Protection Agency (EPA) to review and update clean air regulations related to oil and gas E&P.

· All wastes associated with oil and gas exploration and production are classified under Resource Conservation and Recovery Act (RCRA). This includes mandatory underground injection of produced water and other waste associated with enhancing oil and gas production meet the higher standards. Meeting higher standards on this can cause considerable cost increase on exploration and production for oil and gas.

· The implementation of stricter Spill Prevention, Control, and Countermeasure (SPCC) requirements issued by EPA to improve such measures on any site where there is a risk of an oil and gas spill.

· Pushing the oil industry to dispose all the fracturing fluids and materials used in hydraulic fracturing of oil and gas wells to be injected underground. This even might not be possible at some well sites.

And the result of these regulations

· Loss in royalties and taxes to the government due to decreased exploration or declining oil production

· 183,000 barrels per day lost, or 7 percent of U.S. lower-48 onshore oil production in the first year alone.

· 57 percent of producing onshore oil wells in the US could be shut in, and 35% of producing onshore gas wells.

· Drilling for unconventional gas can be negatively impacted leading to supply issues in the future.

· Loss of 245 billion cubic of gas in the initial first years of regulations

· $10 billion first year, up to $75 billion over 25 years are the estimated compliance costs.

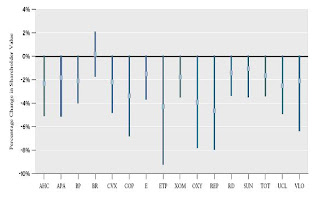

Figure. 3 shows what will happen to the share values of the company if such kind of regulations are placed on the oil industry. This study was carried out by world energy institute on some prominent companies in the E&P industry. Therefore reduced value and earning of the companies can significantly affect national and local economies and one example is reduced jobs.

Fig 3. Impact of environmental regulations on the shareholder values of some of the major producers in the oil and gas industry.

Fig 3. Impact of environmental regulations on the shareholder values of some of the major producers in the oil and gas industry.References

1. The European Commission, “Green Paper on greenhouse gas emissions trading within the European Union,” COM (2000)87 (European Union, 2000).

2. Richard Rosenzweig et al., “The Emerging International Greenhouse Gas Market” (Arlington, Virginia: Pew Center on Climate Change, March 2002).

3. Intergovernmental Panel on Climate Change, “Climate Change 2001: The Scientific Basis—Summary for Policymakers: A Report of Working Group I of the Intergovernmental Panel on Climate Change” (Geneva, Switzerland: IPCC, 2001), p. 10.

4. Lans A. Bovenberg and Lawrence Goulder, “Neutralizing the Adverse Industry Impact of CO2 Abatement Policies: What Does It Cost,” C. Carraro and G.E. Metcalf, eds., Behavioral and Distributional Impacts of Environmental Policy (Chicago: University

of Chicago Press, 2001)

5. “Changing Oil”, a report published by World energy institute in 2008.

1 comment:

Interesting insights. Though ExxonMobil has in the past made statements against the validity of global warming, they are starting to recognize the need to reduce GHG emissions according to this article which quotes Dr. Webber http://online.wsj.com/article/SB123146091530566335.html. GHG emission reductions are also highlighted in ExxonMobil annual reports.

As you said that the oil and gas production is moving to more sensitive regions in Africa, I think an important question is to look at the differences between onshore and offshore production. I don't really know much about this besides on shore production is easily subjected to violence such as bombings which has horrendous environmental impacts as wells burn and pipelines leak gas and oil into the environment.

Post a Comment